Transform Your Credit in as Little as 45 Days w/ a Proven Results Strategy!

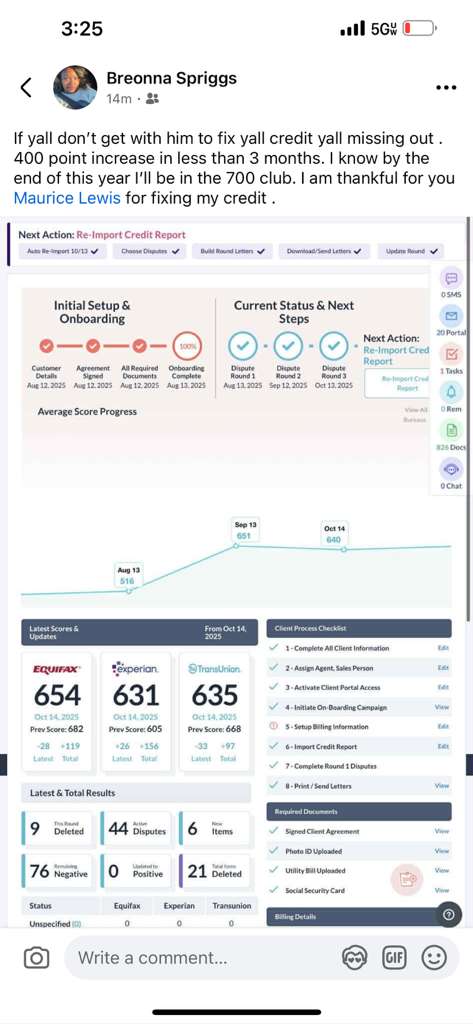

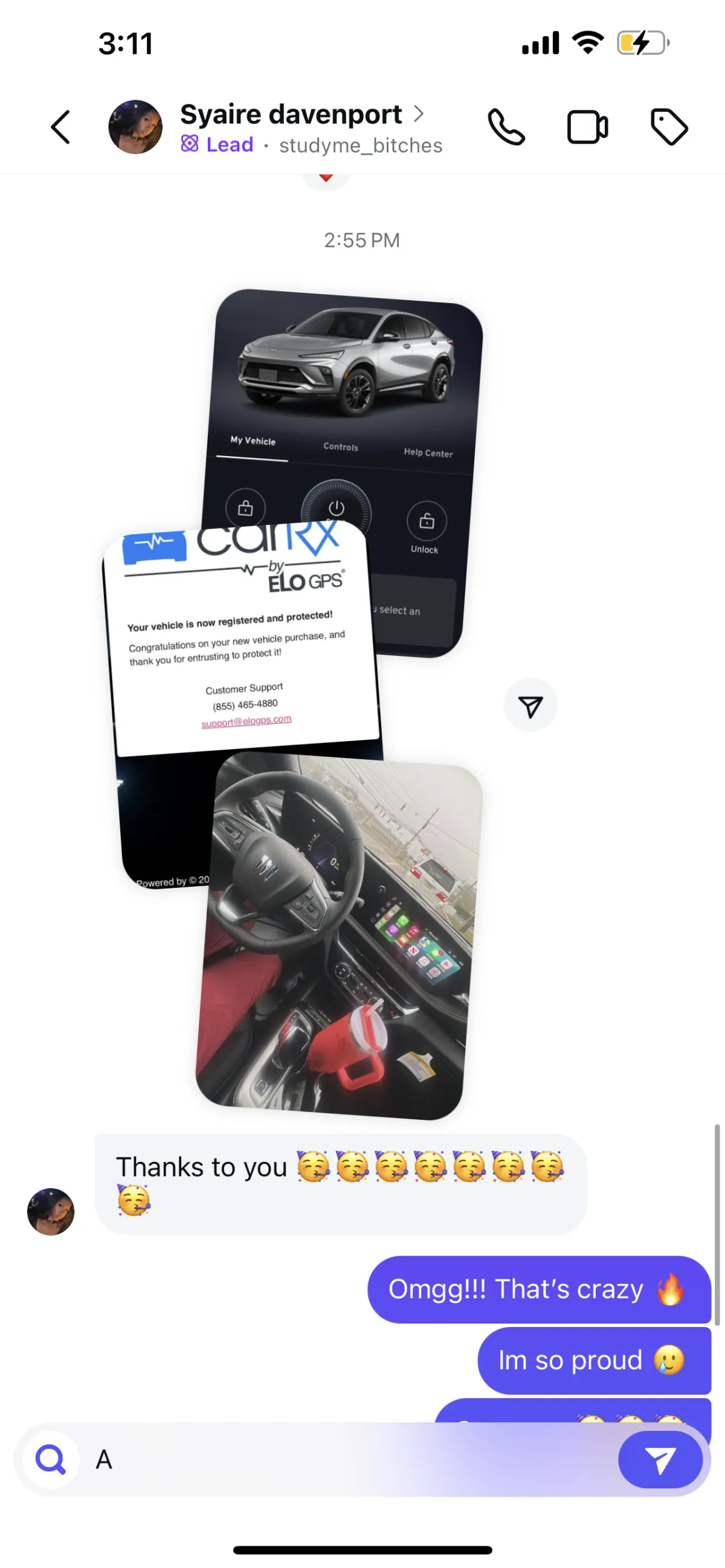

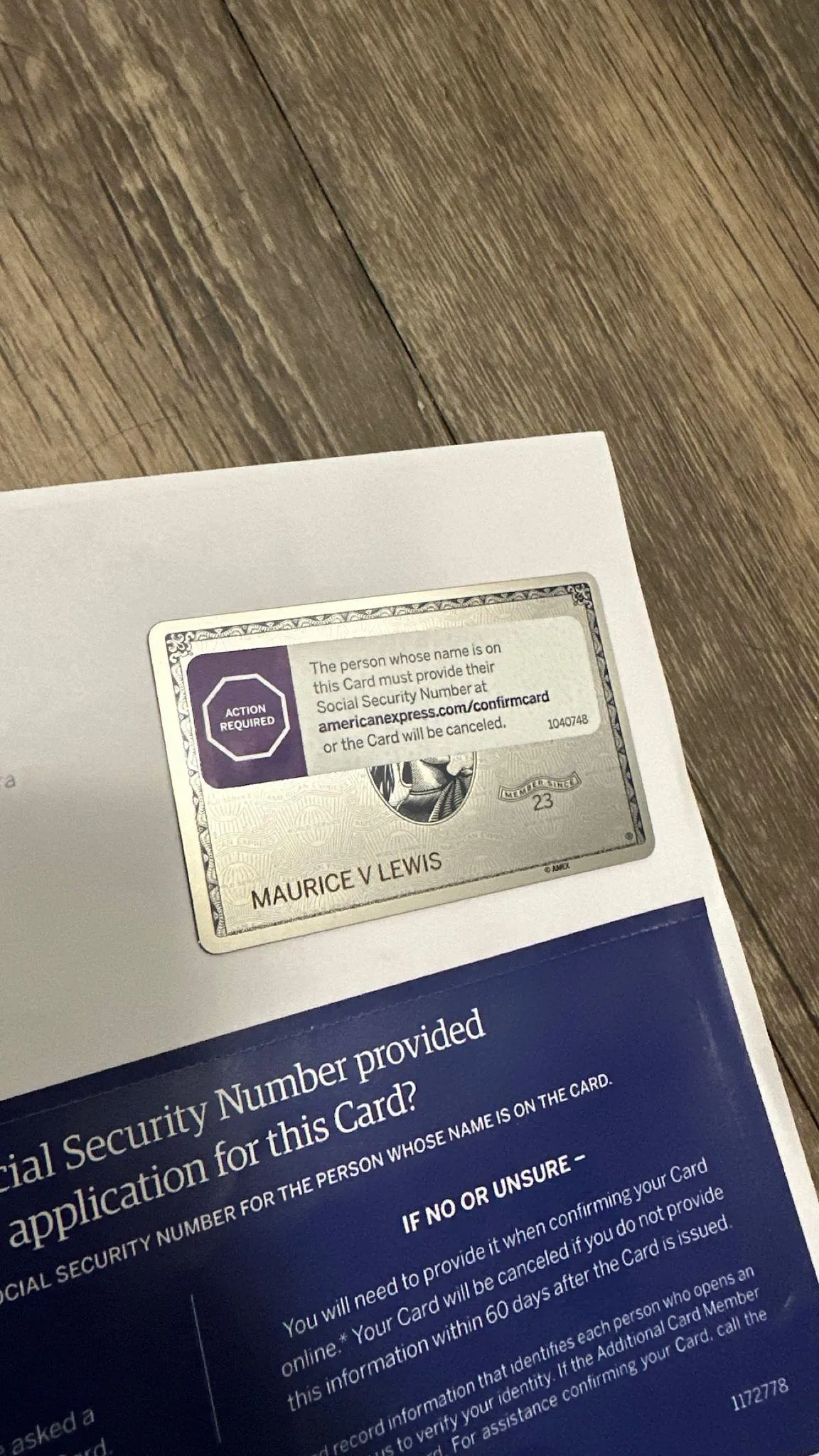

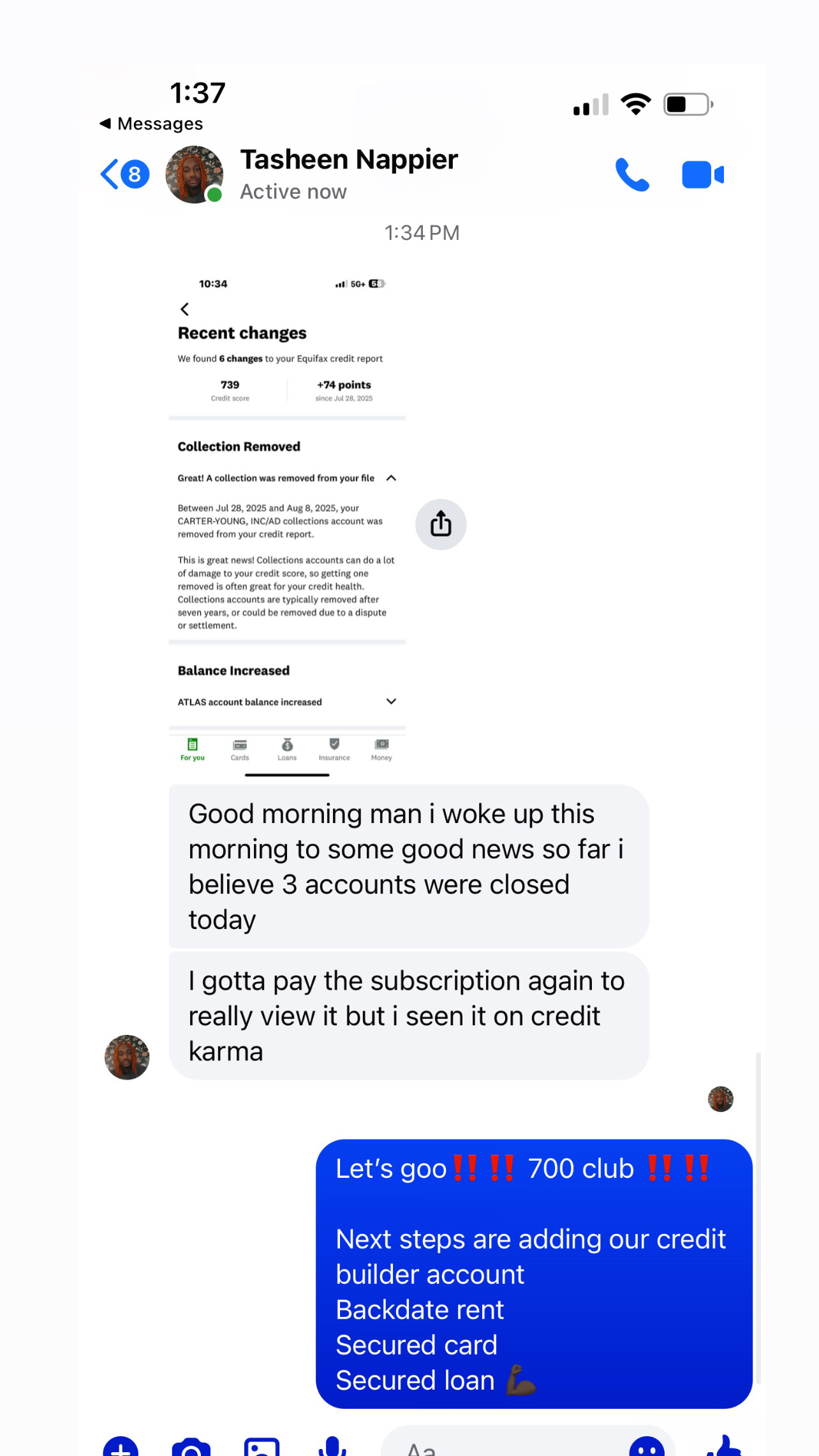

Trusted by 3,500+ clients - Our Administrative Process is backed by our 5-Star Value Client Reviews!

ARE YOU NEXT?

I've Helped Over 3,500 PEOPLE REMOVED OVER 80 MILLION IN DEBT!

Real people. Real progress.

HERES WHAT OTHERS ARE SAYING!

QUICK BENEFITS

Dispute strategy based on your unique credit file

Guidance on what to do while disputes process (utilization, accounts, timing)

Client portal + step-by-step onboarding so nothing gets missed

WHAT EXACTLY DO YOU NEED RIGHT NOW?

Stop guessing. Start a structured dispute process built around your credit file.

Collections

Charge-offs

Late payments

Repossessions

Hard inquiries

Public records (where applicable)

Medical collections

Student loans (case-by-case)

Evictions

HOW DOES CREDIT REPAIR WORK?

You’ll see exactly what to do inside the portal—no guessing, no “random steps.”

STEP-BY-STEP NO GUESSING.

YOURE NOT DOING THIS ALONE, THERES REAL GUIDANCE INSIDE THE PORTAL.

WE VALUE RECEIPTS OVER PROMISESsss

HIGH VOLUME NOTICE

Due to high demand, onboarding + file review may take 1-3 business days.

On regular days, onboarding is 24 hours.

+

WHO YOUR'E WORKING WITH

I’m Maurice (Lucky). I don’t just “do credit repair”—I believe in changing what people accept as normal. Too many families are stuck paying higher interest, getting denied, or living with stress because of reporting mistakes and systems that rarely explain themselves. The bureaus and outside entities should be held accountable, and consumer law is one of the only ways to make that happen.

I’ve spent the last five years locked in—studying, testing, documenting, and refining my process until it became something I can stand behind with confidence. I’ve implemented these strategies across 3,500 individual cases, learning how different profiles respond, what gets traction, what doesn’t, and how to build a system that actually moves.

My goal isn’t just a temporary win. It’s a full turnaround: clean up what’s hurting you, build up what’s missing, strengthen your profile, and then guide you into the funding lane with a real plan—banks, secured products, and a strategy that makes sense for your situation. This is bigger than business to me. I’m fully committed to helping you take control and keep it.

Frequently Asked Questions

Do you guarantee deletions?

No—credit outcomes vary. We follow a structured process to challenge inaccurate, incomplete, or unverifiable reporting where applicable.

How fast will I see results?

Some people see movement in the first 30–90 days, but timelines vary by credit file and creditor response.

What do I need to start?

Credit monitoring login + ID + proof of address + your portal completed.

What if I get stuck on the portal?

The portal includes a step-by-step walkthrough video and support prompts so you’re not stuck guessing.

Do I need a consultation?

Not always. Most people can start with our Credit Sweep and onboarding, and we’ll review your reports + build a plan from there. If your situation is more complex (identity theft, mixed files, multiple repos/collections, lawsuits, or urgent deadlines), a consultation can help us map the fastest route.

How long does it take to see results?

It depends on what’s on your report and how fast the bureaus/creditors respond, but many clients see movement after the first dispute cycle. Some results happen quickly, others take multiple rounds. Consistency and accurate documentation speed everything up.

What items can you remove?

We focus on removing or correcting items that are inaccurate, incomplete, unverifiable, outdated, or reporting incorrectly, such as:

• Collections

• Charge-offs

• Late payments (when disputable)

• Repossessions

• Hard inquiries (when disputable)

• Medical collections (case-by-case)

• Public records (where applicable)

Results vary based on your specific credit file and creditor reporting.

How can I improve my score?

Score improvement is a mix of removals + rebuilding. We help you:

• Clean up negative reporting where possible

• Lower utilization (best practice: under 10–30%)

• Build positive payment history

• Add the right accounts at the right time (secured cards/loans when needed)

• Avoid score-killers (new inquiries, maxed cards, missed payments)

Where can I see my credit reports? Is there a charge for this?

You can view your full reports through the portal after onboarding, and we’ll guide you on exactly where to pull them. Some services may have a small monthly fee depending on the provider you choose, but we’ll tell you the best option for your situation.

How long does it take to fix my credit?

There’s no one-size timeline. Some files clean up in a few months, others take longer depending on the amount of negative items, how they’re reported, and how quickly responses come back. The goal is to make progress every cycle and build long-term score stability—not just a temporary spike.

YOUR NEXT "YES" STARTS HERE.

READY TO TAKE CONTROL TODAY?

Major Solutions provides credit education and credit repair-related services. Results are not guaranteed and vary by individual credit profile, participation, and creditor reporting practices.

Start your comeback story today.

Major Solutions works with clients in all 50 states, offering personalized strategies, transparent communication, and measurable results.

Whether you’re repairing your personal credit, seeking business funding, or simply ready to learn how to play the financial game at a higher level — the team is ready to help.

© Copyright 2026 Immense Ability - All Rights Reserved.